The best way to characterize getting seed money for a small business in a fast-paced, viable placing like New York is with a weird term: nothing short of hell. Most small businesses rarely receive loans from banks, and it appears that getting funding is even more difficult for new business owners. The term “crowdfunding,” which isn’t particularly interesting, is used. A more accessible, modern method of raising funds and building a loyal following around your concept.

This guide covers the top Crowdfunding Platforms for small business crowdfunding in NYC, including how they operate, how much they cost, and which one is best for you, whether you’re starting a tech startup in Manhattan, an artsy little boutique in Brooklyn, or a food truck in the Bronx.

Why Crowdfunding Platforms Makes Sense for NYC Businesses

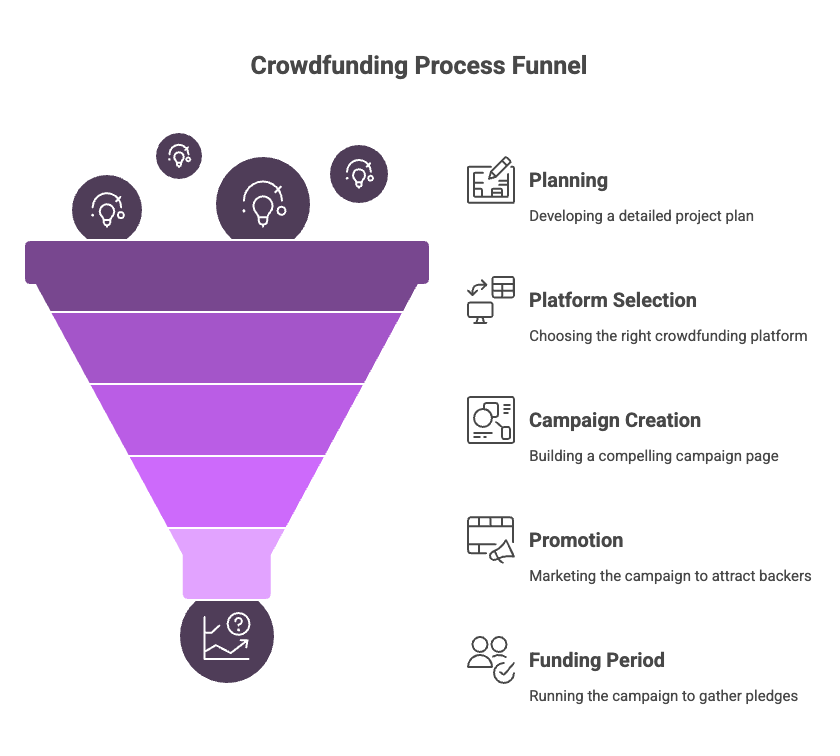

The City of New York is a cultural and entrepreneurial hive where the local population prizes innovation, creativity, and social impact. Crowdfunding harnesses this energy by empowering local founders to:

- Validate their business idea before launching

- Raise startup capital without debt

- Build a community of backers and potential customers

- Increase visibility and buzz through campaign exposure

Crowdfunding usually serves as a marketing campaign and, unlike loans, does not always require payment. You can reach thousands, if not millions, of potential supporters with the right platform.

1. Kickstarter – Best for Creative Products & Consumer Goods

Model: Rewards-based (All-or-Nothing)

Platform Fees: 5% + Payment processing (~3–5%)

Funding Type: Fixed goal (must meet full goal to receive funds)

Best For: Product-based businesses, creative ventures, gadgets

The best platform for product-based crowdfunding is Kickstarter. This is where to start if you’re introducing an item that is real, such as clothing, electronics, games, or artwork. Your campaign may go viral thanks to Kickstarter’s huge user base, but keep in mind that it could go either way. You lose all of the money that was committed if you fail to reach your target.

NYC Tip: Use storytelling to your advantage — tie your product’s purpose to the spirit of New York or the borough it represents. Authenticity sells here.

2. Indiegogo – Best for Flexible Fundraising & Tech Projects

Model: Rewards-based (Fixed or Flexible)

Platform Fees: 5% + Payment fees (~3%)

Funding Type: Flexible (keep funds even if goal isn’t reached)

Best For: Tech gadgets, local services, niche communities

Indiegogo offers way more flexibility than Kickstarter. You can just keep the funds raised even if you don’t reach your full goal. This is perfect for small businesses for which funding expectations are realistic or are testing a new concept. Indiegogo has the feature known as “InDemand,” which makes it possible for you to continue selling your product even after the campaign ends.

NYC Tip: Pair Indiegogo with local PR outreach or TikTok campaigns to amplify traction — flexibility makes it easier to experiment.

Read more : How to Launch a Crowdfunding Campaign in NYC: Step-by-Step Guide

3. Wefunder – Best for Equity Crowdfunding

Model: Equity (Reg CF – Regulation Crowdfunding)

Platform Fees: Around 7.9%

Funding Type: Equity (you give away a small stake in your business)

Best For: Startups and scalable small businesses

Wefunder enables small businesses to generate revenue through equity, small pieces of ownership, to the ordinary non-accredited investors. It is ideal particularly for a growing tech startup or community-based venture needing capital beyond reward-based platforms.

The platform consists of a strong community of investors and compliance with SEC regulations in providing assistance.

NYC Tip: If you’re a Bronx startup, Wefunder can help you raise money from your own neighbors, customers, and fans. Local investors tend to back founders they can meet and trust.

Table of content

Table of Contents

4. SeedInvest – Best for Vetted Startups Seeking High-Value Investors

Model: Equity

Platform Fees: 2% + transaction fees

Funding Type: Equity-based, heavily curated

Best For: High-growth, investor-ready startups

SeedInvest is a high-end equity crowdfunding platform. It’s not for everyone-your business really needs to go through a severe vetting process. But if admitted, you get serious investors, many of whom want to support promising startups in high-profile cities such as New York.n major cities like New York.

NYC Tip: Strong pitch decks, market validation, and legal compliance will make or break your chances here. Consider partnering with a local legal or financial advisor to prep.

5. Fundable – Best for Small Businesses Seeking Flexibility

Model: Reward or Equity

Platform Fees: $179/month + payment processing

Funding Type: Hybrid (choose reward or equity)

Best For: Traditional small businesses, retail, service providers

Fundable offers something unique – the platform supports both reward-based and equity crowdfunding. It does charge a monthly fee (even when not raising), but it’s suitable for a company that wants more control over its campaign. These are perfect for businesses looking for developmental capital that aren’t really flashy startups.

NYC Tip: Use Fundable if you want to raise money for a physical storefront, barbershop, bakery, or another Bronx or Brooklyn-based service.

6. GoFundMe – Best for Community & Cause-Based Campaigns

Model: Donation-based

Platform Fees: 2.9% + $0.30 per transaction

Funding Type: Keep whatever you raise

Best For: Mission-driven businesses, crisis recovery, nonprofits

GoFundMe is not a conventional means by which to raise funds for business, but it is quite effective in raising funds from the community for small businesses, particularly those for lobbying a social cause. If your café supports local artists or your shop employs youth from low income communities, GoFundMe will be better suited to reward-based platforms for funds.

NYC Tip: Highlight the impact your business has on your neighborhood. Emotional storytelling matters more here than slick marketing.

7. Fundly – Best for Nonprofits & Social Enterprises

Model: Donation-based

Platform Fees: 4.9% + payment processing

Funding Type: Flexible

Best For: Educational programs, nonprofits, purpose-led small business

Fundly is good for social enterprises and nonprofits that require community backing. The interface is simple to use, works well on mobile devices, and integrates easily with Facebook. While the fees for Fundly are a little higher than those for GoFundMe, the site does offer nonprofits superior tools.

NYC Tip: This is great for after-school programs, community gardens, or neighborhood revitalization efforts.

| Platform | Model | Fee Structure | Best Use Case |

|---|---|---|---|

| Kickstarter | Rewards | 5% + 3–5% | Product launches, creative ventures |

| Indiegogo | Rewards | 5% + 3% + $0.30 | Tech & creative campaigns |

| Wefunder | Equity | ~7.9% | Startups seeking equity funding |

| SeedInvest | Equity | 2% + fees | Vetted high-growth businesses |

| Fundable | Rewards/Equity | $179/mo | Brick-and-mortar or hybrid SMBs |

| GoFundMe | Donations | 2.9% + $0.30 | Mission-driven & community projects |

| Fundly | Donations | 4.9% + 2.9% + $0.30 | Nonprofits and social impact orgs |

🔑 Final Tips for NYC Crowdfunding Success

- Particularize your campaign by infusing neighborhood references, local pride, and the NYC culture into your pitch.

- Put videos and testimonials to good use. People love watching your story unfold- put faces, voices, and visuals of your business and the community into the presentation.

- Eliminate the term “platform” when promoting. Promote your campaign on Instagram and through local media and events in Harlem, Bushwick, or the South Bronx.

- Deliver actual value. Donation-based campaigns even get better with creative perks or public recognition.

- Stay true to your word. Being transparent during and after the campaign creates long-lasting trust and customer loyalty.

✍️ Conclusion

Crowdfunding is not merely a means of funding but a way to get started. In a city as ambitious and diverse as New York, platforms like Kickstarter, Wefunder, Indiegogo, and GoFundMe give small businesses a fighting chance to grow with the help of their own community.

Whether you’re a sole proprietorship based out of Queens or a Bronx-based social enterprise, a platform exists for you. So, choose wisely, plan deeply, and tell your story with heart.